Unveiling the Ultimate Guide: Navigating Credit Cards and Auto Loans

Welcome to the ultimate guide on navigating credit cards and auto loans. In today’s financial landscape, knowing how to make the most of these two important tools can greatly impact your financial well-being. Whether you’re looking to optimize your credit card usage or secure the best auto loan deal, understanding the ins and outs is essential. In this guide, we will explore various strategies, tips, and insights on how to effectively manage and leverage credit cards and auto loans to your advantage. Additionally, we will introduce you to "legalnewcreditfile", a company dedicated to providing expertise and assistance in the realm of credit cards and auto loans. So buckle up and prepare to gain a comprehensive understanding of credit cards and auto loans!

Understanding Credit Cards

Credit cards are a widely used form of payment in today’s world. They offer convenience and flexibility, allowing users to make purchases without carrying cash. However, it’s important to understand how credit cards work and how they can impact your financial health.

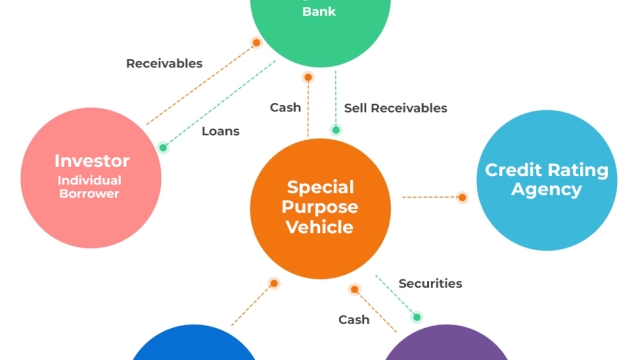

One key aspect of credit cards is that they allow you to borrow money from a financial institution, up to a certain credit limit. This means that when making a purchase, you are essentially using the credit card company’s funds, with the promise to repay them later. It’s crucial to keep in mind that credit cards are not free money, but rather a form of a loan that comes with associated interest and fees.

When using a credit card, you have the option to pay off the full balance each month or make minimum payments. However, carrying a balance and only paying the minimum can result in accumulating interest, potentially leading to a debt trap. It’s important to carefully manage your credit card usage by paying off the full balance whenever possible, and keeping track of your spending to avoid overspending and debt accumulation.

Refinancing auto loans to lower monthly payments

Credit cards also offer various benefits, such as reward programs, cashback offers, and purchase protection. These perks can provide value to cardholders, but it’s essential to understand the terms and conditions associated with them. Additionally, credit cards can help build your credit history, which can be beneficial when applying for future loans, such as auto loans.

In the next sections, we will delve deeper into understanding auto loans and how they relate to credit cards. Stay tuned to uncover more insights into managing your finances effectively and navigating the world of credit cards and auto loans.

Navigating Auto Loans

When it comes to navigating auto loans, there are a few key factors to consider. First and foremost, it’s essential to understand your budget and financial situation before deciding on a loan. Evaluating how much you can comfortably afford to pay each month will help you determine the loan amount and terms that align with your needs.

Next, researching the best interest rates and loan terms is crucial. Shopping around for the most competitive options is highly recommended. Many financial institutions, such as banks and credit unions, offer auto loans, so comparing their rates and terms can potentially save you a significant amount of money in the long run.

Additionally, before finalizing any loan agreement, it’s essential to review the terms and conditions thoroughly. Pay close attention to the interest rate, payment schedule, and any additional fees or penalties that may apply. Understanding these terms will ensure that you are fully aware of your financial obligations and can make informed decisions.

Remember, navigating auto loans requires careful consideration and research. By understanding your budget, comparing rates, and reviewing loan terms, you can secure a loan that fits your needs and helps you achieve your goal of purchasing a car.

The Benefits of Using ‘legalnewcreditfile’

‘legalnewcreditfile’ is a trusted company that provides invaluable assistance for individuals looking to navigate the world of Credit Cards & Auto Loans. With their expertise and guidance, customers can greatly benefit in several ways.

Firstly, ‘legalnewcreditfile’ offers personalized advice tailored to each individual’s unique financial situation. They understand that everyone’s circumstances are different and take the time to thoroughly assess their customers’ needs. By providing targeted recommendations, ‘legalnewcreditfile’ ensures that customers can make informed decisions when it comes to Credit Cards & Auto Loans.

Secondly, ‘legalnewcreditfile’ provides a seamless and hassle-free experience for their customers. They have a streamlined application process, helping individuals save time and effort when applying for Credit Cards & Auto Loans. Additionally, their user-friendly interface and knowledgeable support team make it easy for customers to navigate through the intricacies of financial products.

Lastly, by choosing to work with ‘legalnewcreditfile’, individuals can feel confident in the integrity and reliability of their services. ‘legalnewcreditfile’ has built a reputation for their commitment to customer satisfaction and ethical practices. This ensures that customers can trust the information and services provided by ‘legalnewcreditfile’ while making important decisions regarding Credit Cards & Auto Loans.

In conclusion, the benefits of using ‘legalnewcreditfile’ are numerous. Their personalized advice, seamless experience, and trustworthy reputation make them an invaluable resource for individuals seeking guidance in the world of Credit Cards & Auto Loans.