The banking sector has undergone significant transformations over the years, with automation playing a crucial role in shaping its future. Banking automation, a concept that once seemed futuristic, is now a reality that is revolutionizing the way financial institutions serve their customers. With advancements in technology and the ever-increasing demand for seamless and efficient banking experiences, automation has become a necessity rather than a luxury.

Gone are the days of long queues at bank branches and tedious paperwork. Thanks to banking automation, customers can now enjoy enhanced convenience, speed, and accuracy in their banking transactions. From self-service kiosks and mobile banking apps to automated teller machines (ATMs) and chatbots, the banking industry is embracing automation in various forms to cater to the evolving needs and preferences of its customers.

By leveraging banking automation solutions, financial institutions can offer personalized and streamlined services, ensuring a superior customer experience. From opening new accounts to processing loan applications, automation simplifies and expedites complex processes, reducing the potential for errors and manual intervention. Additionally, automation enables 24/7 access to banking services, allowing customers to perform transactions at their convenience, anytime and anywhere.

This guide will delve into the different aspects of banking automation, exploring the benefits, challenges, and best practices for embracing automation in the industry. Whether you’re a customer looking to leverage the advantages of automated banking services or a financial institution seeking to optimize your operations, this guide will serve as a comprehensive resource to navigate the world of banking automation. So fasten your seatbelts and get ready to embark on an exciting journey into the future of banking!

Benefits of Banking Automation

Banking automation offers numerous benefits that enhance the overall customer experience. By leveraging cutting-edge technology, banks can streamline their operations and provide a more efficient, secure, and personalized service to their customers.

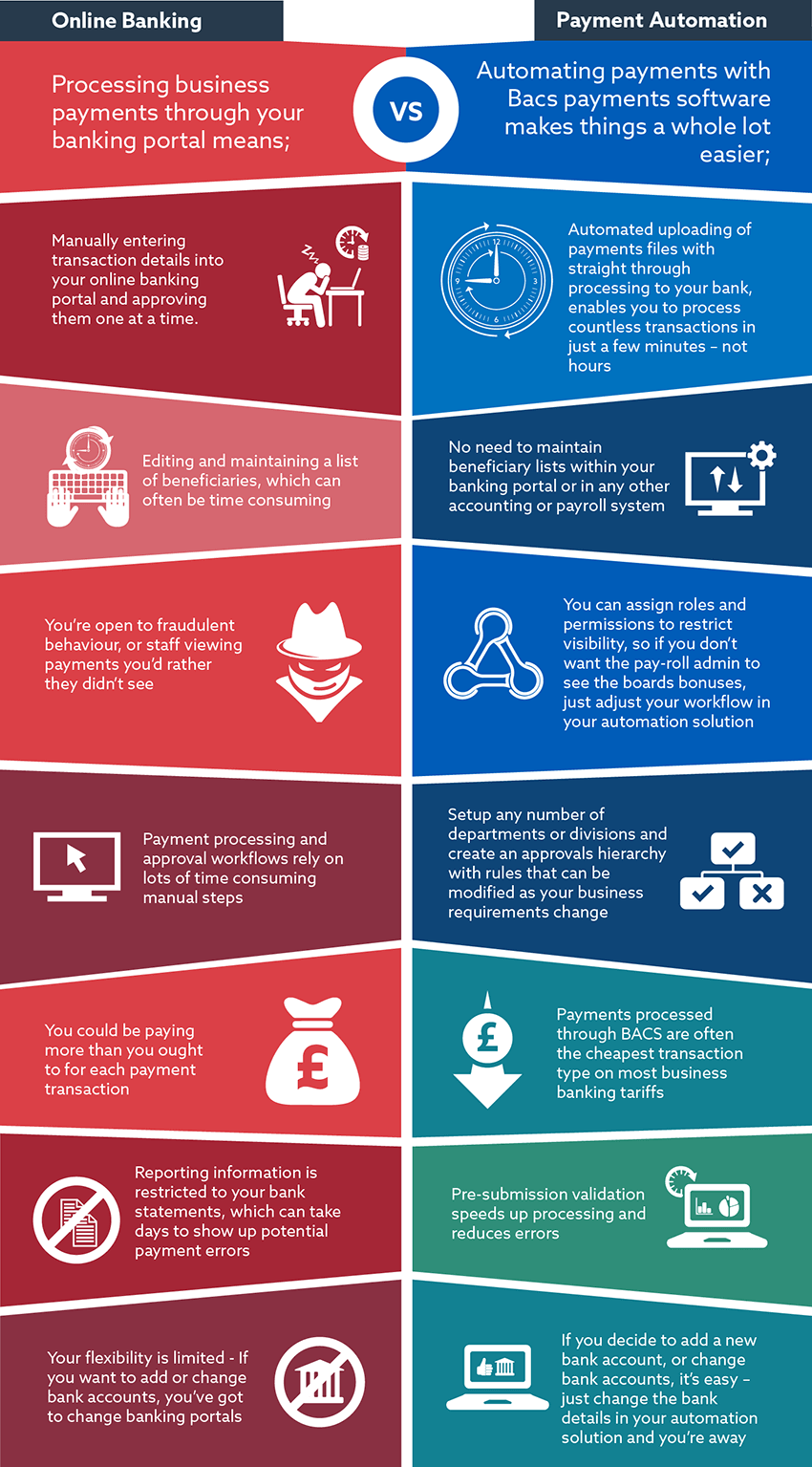

Increased Efficiency: With banking automation, routine tasks such as account opening, transaction processing, and document verification can be automated. This allows banks to reduce manual errors and expedite the process, leading to faster and more accurate customer service. Automation also enables banks to handle a larger volume of transactions without increasing their workforce, resulting in cost savings and improved operational efficiency.

Enhanced Security: Implementing banking automation solutions ensures rigorous security measures are in place to protect customer data and prevent fraud. Automated systems can detect anomalies, monitor transactions in real-time, and employ multi-factor authentication techniques, making it more difficult for unauthorized access and fraudulent activities to occur. This not only safeguards customer assets but also instills trust and confidence in the banking institution.

Personalized Customer Service: Banking automation enables banks to gather and analyze vast amounts of customer data. By leveraging advanced analytics tools, banks can gain insights into customer behavior, preferences, and needs. This data-driven approach allows banks to offer personalized financial products, services, and recommendations tailored to each customer’s unique requirements. Customers feel valued and understood, resulting in improved satisfaction and loyalty.

In conclusion, banking automation brings forth a host of benefits that revolutionize the banking industry. By embracing automation, banks can optimize their operations, enhance security, and deliver a more personalized customer experience. As technology continues to advance, banking automation solutions will undoubtedly play a crucial role in shaping the future of banking.

2. Key Technologies in Banking Automation

The advancements in technology have revolutionized the banking industry, paving the way for enhanced customer experiences through automation. Let’s explore some of the key technologies that are driving this transformation.

-

Artificial Intelligence (AI)

AI plays a pivotal role in banking automation by enabling machines to perform tasks that traditionally required human intelligence. Machine learning algorithms analyze vast amounts of data to gain insights into customer behavior, predict trends, and detect fraudulent activities. Chatbots powered by AI provide round-the-clock assistance to customers, answering queries and offering personalized recommendations.

Best Software To Create FormsRobotic Process Automation (RPA)

RPA automates repetitive and rule-based tasks, liberating human resources to focus on more complex and strategic activities. In banking, RPA streamlines processes like customer onboarding, loan application processing, and data entry. By eliminating manual errors and reducing processing time, RPA enhances operational efficiency and accuracy.-

Internet of Things (IoT)

IoT is revolutionizing the way banks and customers interact. Smart devices, such as wearables and connected home devices, enable seamless payments, monitor spending habits, and provide real-time notifications. Additionally, IoT-powered devices can collect data on customer preferences and usage patterns, enabling banks to offer tailored products and services.

These are just a few of the key technologies driving banking automation. As technology continues to evolve, banks must adapt and embrace automation to provide enhanced customer experiences and remain competitive in the ever-changing financial landscape.

3. Implementing Automation for a Better Customer Experience

Automation in the banking sector has revolutionized the way customers interact with their financial institutions. As technology continues to advance, it becomes imperative for banks to embrace automation in order to provide an enhanced customer experience.

The first step in implementing automation for a better customer experience is through self-service options. By offering customers the ability to perform routine transactions using automated channels such as mobile apps or online banking platforms, banks can empower their customers to have more control over their finances. This not only saves time and effort for customers but also reduces the load on bank branches, resulting in a more efficient and seamless experience for everyone involved.

Another crucial aspect of implementing automation is through personalized recommendations and insights. By leveraging artificial intelligence and machine learning algorithms, banks can analyze customer data to provide tailored financial advice and suggest relevant products and services. This level of personalization not only enhances the customer experience but also helps customers make more informed decisions about their financial goals and investments.

Lastly, automation can greatly improve the speed and accuracy of customer service. By integrating chatbots and virtual assistants into customer support channels, banks can provide round-the-clock assistance to customers, resolving their queries and concerns in real-time. This eliminates the need for customers to wait for extended periods or navigate through complex phone menus, resulting in quicker and more efficient customer service interactions.

In conclusion, the implementation of automation in the banking industry offers numerous benefits for both customers and financial institutions. By embracing automation through self-service options, personalized recommendations, and improved customer service, banks can deliver a superior customer experience that is convenient, tailored, and efficient.