Master the Art of Wealth: A Guide to Successful Money Management

In today’s fast-paced and ever-evolving world, achieving financial prosperity and maintaining it can seem like an elusive goal. But fear not, for we are here to guide you on the path to mastering the art of wealth and successful money management. Whether you are at the beginning of your financial journey or seeking to enhance your existing wealth, personal financial planning and effective wealth management strategies are essential pillars of long-term financial success.

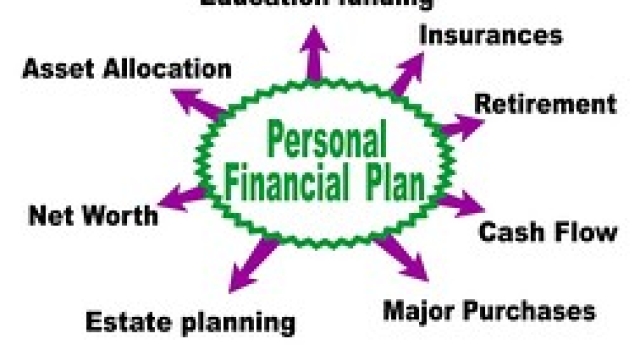

Personal financial planning serves as the foundation for wealth management, allowing individuals to define their financial goals and create a roadmap to achieve them. This holistic approach fosters a clear understanding of one’s current financial situation, identifies opportunities for growth, and designs strategies to mitigate risks along the way. By emphasizing prudent budgeting, strategic investment decisions, and effective tax planning, personal financial planning empowers individuals to make informed choices that align with their long-term wealth objectives.

However, for true mastery of wealth, one must go beyond the realm of personal financial planning and adopt a comprehensive wealth management approach. Wealth management encompasses a broader spectrum of financial disciplines, combining investment management, estate planning, retirement planning, and risk management. Through a collaborative partnership with knowledgeable wealth management professionals, individuals can unlock the full potential of their wealth, while navigating the complexities of the global financial landscape.

Together, personal financial planning and wealth management provide the framework for sustainable long-term wealth accumulation and preservation. By establishing clear financial goals, creating diversified investment portfolios, implementing effective tax strategies, managing risk exposure, and planning for future generations, individuals can forge the path towards financial freedom. So, join us on this transformative journey and unleash the master of wealth that lies within you.

Setting Financial Goals

Setting financial goals is an essential part of personal financial planning. It allows individuals to have a clear vision of their financial future and helps guide their wealth management strategies. By setting specific and achievable goals, individuals can effectively prioritize their resources and make informed decisions about savings, investments, and expenses.

-

Identify Your Priorities: The first step in setting financial goals is determining what truly matters to you. Consider both short-term and long-term objectives. Do you want to save for a down payment on a house? Plan for your child’s education? Or retire comfortably? By understanding your priorities, you can align your financial decisions with these goals.

-

Establish Measurable Goals: Once you have identified your priorities, it’s important to set SMART goals – specific, measurable, achievable, relevant, and time-bound. For example, instead of saying, "I want to save more money," a SMART goal would be, "I will save $10,000 for a down payment on a house within the next two years." Measurable goals provide clarity and help track progress along the way.

-

Break It Down: Sometimes, bigger goals can feel overwhelming. To make them more manageable, break them down into smaller milestones. By focusing on these shorter-term targets, you can stay motivated and celebrate achievements along the way. For instance, if your long-term goal is to save $100,000 for retirement, set smaller milestones such as saving $10,000 within the first year, $30,000 within three years, and so on.

Safest Countries For Black Expats

Setting financial goals allows individuals to have a roadmap for their financial journey. It provides the necessary direction and structure to achieve desired outcomes. By identifying priorities, setting measurable goals, and breaking them down into smaller milestones, individuals can effectively manage their wealth and move closer to financial success.

Creating a Budget

Managing your finances effectively is crucial when it comes to building and growing your wealth. One of the first steps in achieving a successful money management strategy is creating a budget. By establishing a well-thought-out budget, you can gain control over your expenses and ensure that your income is properly allocated.

Start by evaluating your current financial situation. Take into account your monthly income and all of your regular expenses such as rent or mortgage, utilities, groceries, transportation, and any debt payments. Subtracting your total expenses from your income will give you a clear picture of how much disposable income you have each month.

Once you have a clear idea of your income and expenses, it’s time to set financial goals. Define short-term and long-term objectives that align with your aspirations. Whether it’s saving for a down payment on a house or planning for your retirement, having specific goals in mind will help you stay motivated and focused.

Next, prioritize your expenses based on your goals and needs. Consider allocating a certain percentage of your income towards savings and investments. This will provide a solid foundation for your financial future and allow your wealth to grow over time. Remember to also allocate funds for emergencies and unexpected expenses, as being prepared for unexpected circumstances is vital for financial stability.

By following these steps and creating a budget that aligns with your financial goals, you’ll be well on your way to mastering the art of wealth management. Taking control of your finances and having a clear plan in place will allow you to make informed decisions and ultimately achieve financial success.

Investing for Long-Term Wealth

In order to secure long-term wealth, it is crucial to adopt a strategic approach to investing. While short-term gains may seem appealing, investing with a long-term perspective ensures stability and growth over time. By carefully considering various investment options, individuals can build a solid foundation for their financial future.

One key aspect of investing for long-term wealth is diversification. Instead of putting all your eggs in one basket, spreading your investments across different asset classes can help mitigate risks. This could include a mix of stocks, bonds, real estate, and other potential opportunities. Diversification allows you to benefit from different market cycles and reduce the impact of any single investment performing poorly.

Another important consideration for long-term wealth is to focus on quality investments. While it can be tempting to chase after the latest trends or hot stocks, it is wiser to invest in companies or assets that have a proven track record of success. Thoroughly researching and analyzing potential investments can help identify opportunities that are likely to withstand the test of time.

Finally, maintaining a disciplined approach to investing is crucial for long-term wealth creation. It is important to avoid making impulsive decisions based on short-term market fluctuations. Developing a well-thought-out investment plan and sticking to it can help ensure consistency and minimize emotional reactions to market volatility.

By following these principles of diversification, focusing on quality investments, and maintaining a disciplined approach, individuals can lay the groundwork for long-term wealth accumulation. Patience and persistence are key, as successful investing is a journey that requires ongoing monitoring and adjustment. With the right mindset and strategy, achieving lasting financial prosperity becomes a realistic goal.