Protecting Your Business: Unveiling the Benefits of Commercial Property Insurance

Starting a business can be an exciting and rewarding endeavor, but it also comes with a certain degree of risk. From natural disasters to theft or vandalism, there are numerous unforeseen circumstances that can wreak havoc on your commercial property. That’s where insurance comes into play. Insurance provides a safety net, offering financial protection for your business against potential risks and liabilities.

One crucial aspect of business insurance is commercial property insurance. This type of insurance is specifically designed to safeguard your physical assets, such as buildings, equipment, inventory, and furniture, from loss or damage. Commercial property insurance protects your investments and ensures that your business can bounce back even in the face of adversity. Whether you own or lease your commercial space, having the right insurance coverage in place can make all the difference when it comes to protecting your assets and maintaining the continuity of your business operations.

Investing in commercial property insurance offers a range of benefits for business owners. Firstly, it provides coverage for physical damage caused by perils such as fire, theft, vandalism, and natural disasters like hurricanes or earthquakes. In the unfortunate event that your property is damaged, the insurance will cover the costs of repairs or even replacement, minimizing the financial burden on your business. Additionally, commercial property insurance can also include coverage for business interruption expenses, such as lost income, operating expenses, and even temporary relocation costs, ensuring that your business can continue to operate smoothly even during a disruption.

By opting for commercial property insurance, you not only protect your physical assets, but also gain peace of mind knowing that your business is safeguarded against potential risks and uncertainties. It is important to carefully assess your insurance needs and work with knowledgeable professionals to tailor the coverage to suit the specific requirements of your business. Taking the time to properly protect your commercial property today can save you from significant financial losses in the future, allowing you to focus on what matters most – the success and growth of your business.

The Importance of Commercial Property Insurance

Running a business comes with numerous risks and uncertainties. One of the most effective ways to protect your valuable assets is through commercial property insurance. This type of insurance provides coverage for physical structures, equipment, and inventory against unexpected events such as fire, theft, vandalism, and natural disasters.

Having commercial property insurance is crucial for safeguarding your business from potential financial losses. Imagine the devastating impact of a fire or a major flood damaging your commercial property. Without insurance, you would have to bear the entire cost of repairing or replacing your building and its contents. This could not only drain your finances but also put your business operations at risk.

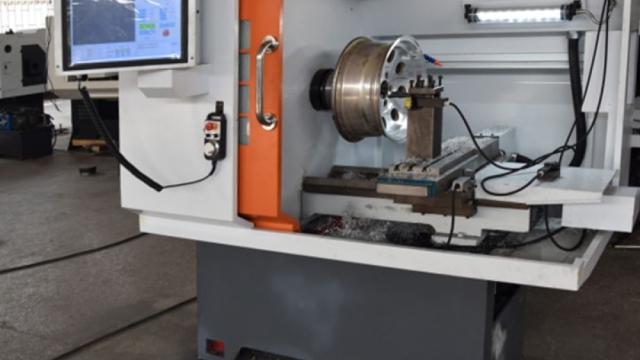

Commercial property insurance not only covers the physical structures but also extends its protection to the equipment and inventory within your premises. Machinery breakdowns, thefts, or damages to your stock can have a detrimental effect on your business. By having a comprehensive insurance policy, you can rest assured that you will be financially supported in case of any such unfortunate incidents.

Moreover, commercial property insurance can also provide liability coverage. This means that if someone gets injured on your property or if your property causes damage to someone else’s belongings, you will have the necessary coverage to handle the legal and financial obligations that may arise. Without this insurance, you could be held personally liable for any damages or injuries, jeopardizing not only your business but also your personal assets.

In conclusion, commercial property insurance is an essential investment for any business owner. It protects your business from unexpected events, secures your physical assets, and provides liability coverage. By taking proactive steps to safeguard your business with the right insurance policy, you can focus on what matters most – running and growing your business with peace of mind.

Coverages Offered by Commercial Property Insurance

Commercial property insurance offers a wide range of coverages that help protect businesses from unexpected losses. Whether you own a small shop or a large manufacturing facility, having the right insurance can provide you with the peace of mind you need to focus on growing your business. In this section, we will explore some of the key coverages offered by commercial property insurance.

First and foremost, commercial property insurance provides coverage for the physical structure of your business property. This includes the building itself, as well as any permanent fixtures, such as walls, floors, and ceilings. In the event of damage caused by perils like fire, vandalism, or severe weather, this coverage will help you recover the costs of repairs or rebuilding.

Additionally, commercial property insurance also covers your business’s contents. This includes items such as furniture, equipment, inventory, and even computers. If these items are damaged or destroyed due to covered perils, the insurance will help you replace or repair them, allowing you to quickly resume your operations.

Another important coverage provided by commercial property insurance is business interruption insurance. This coverage is designed to help businesses recover lost income and cover ongoing expenses in the event that your business is temporarily unable to operate due to a covered loss. Whether it’s a fire, a natural disaster, or other unforeseen events, having business interruption insurance can be invaluable in protecting your business’s financial stability during challenging times.

In conclusion, commercial property insurance offers a wide range of coverages that help safeguard your business assets and provide financial protection in the face of unexpected events. From protecting the physical structure of your property to covering your business’s contents and providing business interruption coverage, having the right insurance policy can be essential in ensuring the continued success and resilience of your business.

Tips for Choosing the Right Commercial Property Insurance Policy

- General Liability Insurance Ohio

-

Assess Your Business Needs

Before selecting a commercial property insurance policy, it is essential to assess your specific business needs. Begin by evaluating the value of your commercial property, including the building structure and any additional assets such as inventory, equipment, or furniture. Consider the potential risks and hazards your business might face, such as fire, theft, or natural disasters. By understanding your unique requirements, you can ensure that the policy you choose adequately covers all potential risks. -

Understand Coverage Options

Commercial property insurance policies can offer various types of coverage, so it’s crucial to have a clear understanding of the options available to you. Common coverage options include property damage, business interruption, liability protection, and equipment breakdown. Take the time to carefully review and compare the coverage options provided by different insurers. Consider the specific risks faced by your business and choose a policy that offers comprehensive coverage for those risks. -

Compare Quotes and Insurers

To make an informed decision, it is essential to compare quotes and insurers. Obtain multiple quotes from different insurance providers, and carefully evaluate the coverage and premiums offered by each. Look beyond just the cost and consider the reputation and financial stability of the insurers. Reading customer reviews and seeking recommendations from other business owners can provide valuable insights into the reliability and customer service of different insurers. By comparing quotes and insurers, you can ensure that you are getting the best possible coverage for your business at a competitive price.

Remember, choosing the right commercial property insurance policy is a crucial step in protecting your business from potential risks and uncertainties. By following these tips, you can make an informed decision and safeguard your business assets effectively.